Calculate GST amount, final price, and tax breakdown for Indian products and services

Free GST Calculator

Are you tired of manually calculating taxes on your business transactions? Simplifying GST calculations is now easier than ever. With the Goods and Services Tax, businesses in India have seen a big change in their tax duties.

You can now easily determine your tax liabilities using our easy tool. Our free gst calculator makes GST calculations simple. This saves you time and cuts down on mistakes.

Key Takeaways

- Simplify GST calculations with our online tool.

- Save time and reduce errors in tax calculations.

- Understand your tax liabilities with ease.

- Access a free and user-friendly GST calculator.

- Streamline your business operations with accurate GST calculations.

Understanding GST in India

To understand India’s taxes, knowing about GST is key. GST makes taxes simpler by combining many into one.

What is Goods and Services Tax?

Goods and Services Tax (GST) is a big tax on goods and services. It’s a Indian GST calculator friendly system. It makes figuring out taxes easier.

History and Implementation of GST in India

GST started in India on July 1, 2017. It changed the tax system a lot. GST made taxes simpler and helped with tax following.

Types of GST: CGST, SGST, IGST, and UTGST

GST has four types: CGST, SGST, IGST, and UTGST. CGST and SGST/UTGST are for local sales. IGST is for sales between states. A goods and services tax calculator or GST calculation tool helps find the right GST rates.

Why You Need a GST Calculator

Finding out GST can be hard and slow without the right tools. Businesses in India must calculate GST accurately. This is to follow tax rules and avoid fines.

Complexity of Manual GST Calculations

Doing GST by hand is hard and can have mistakes. It’s tricky because of different tax rates. Also, you have to know the difference between CGST, SGST, IGST, and UTGST. A small mistake can cause big problems with money.

| GST Type | Applicability | Tax Rate |

|---|---|---|

| CGST | Intra-state transactions | Variable |

| SGST | Intra-state transactions | Variable |

| IGST | Inter-state transactions | Variable |

Benefits of Automated GST Calculation

A gst tax calculator makes things easier and cuts down on mistakes. An accurate gst calculator helps businesses figure out their taxes fast. This makes managing money and following GST rules simpler.

For companies, a gst calculator for businesses is very important. It saves time and helps with planning money. By automating GST, businesses can grow and improve.

How Our Free GST Calculator India Works

Our online GST calculator is easy to use. It helps you figure out GST for your business or personal needs.

Features of Our Online GST Calculator

Our online GST calculator has cool features. It lets you quickly find out GST for many kinds of deals. This saves you time and makes sure you get it right.

The calculator works with different GST rates. This makes it great for all sorts of business needs.

Step-by-Step Guide to Using the Calculator

Using our GST percentage calculator is easy. Here’s how:

Entering Base Amount and GST Rate

First, put in the amount you want to calculate GST for. Then, add the GST rate. Our gst calculator india works with many GST rates. This means you can figure out GST for all kinds of deals.

Understanding the Results

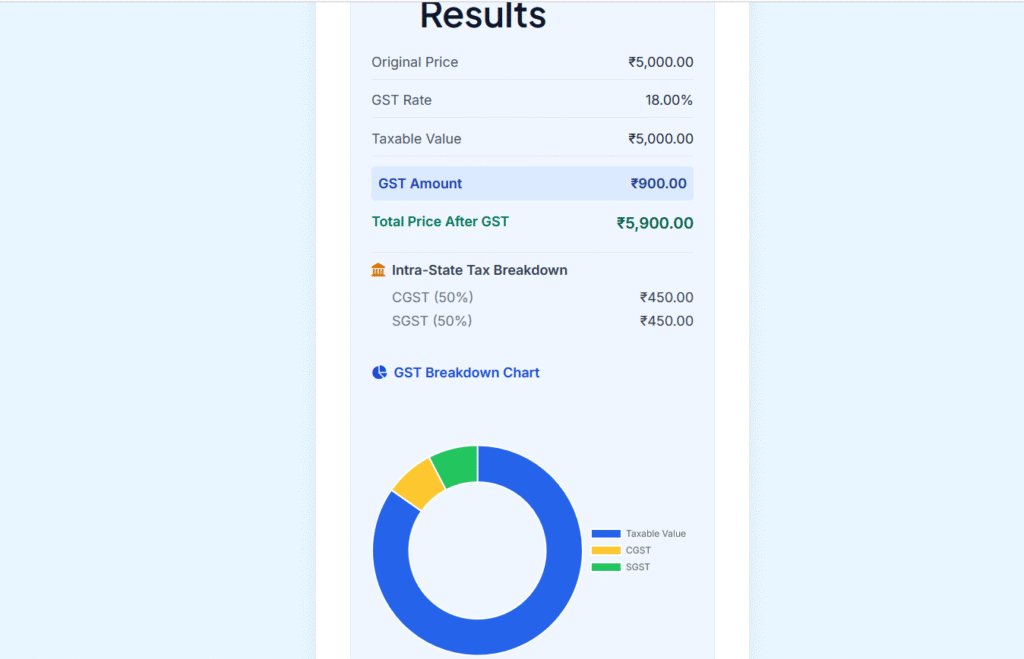

After you enter the info, our india gst calculator online shows the GST amount. It also shows the total amount after adding GST. This makes it simple to see the final cost or earnings.

Mobile and Desktop Compatibility

Our GST calculator works on both phones and computers. You can use it anywhere, anytime. This makes it super convenient and flexible.

Different Methods of GST Calculation

GST calculation has many ways. Each way has its own use. Knowing these helps businesses pay the right taxes and follow Indian tax rules.

Calculating GST from Base Amount

This method adds a GST percentage to the base amount. It’s easy and often used.

Formula and Example

To find GST, use this formula: GST Amount = (Base Amount * GST Rate) / 100. For example, with a base amount of ₹100 and a 18% GST rate, the GST is ₹18.

When to Use This Method

Use it when you know the base amount and GST rate. It’s good for making bills and invoices.

Extracting GST from Inclusive Amount

This method finds GST in a total amount that includes GST. It’s helpful for looking at invoices with GST included.

Formula and Example

The formula is: GST Amount = (Total Amount * GST Rate) / (100 + GST Rate). For example, with a total of ₹118 and an 18% GST rate, the GST is ₹18.

When to Use This Method

It’s great for invoices where GST is already included in the total.

Calculating Net Amount After GST

This method adds or subtracts GST from the base amount. It depends on whether you’re finding the total or the original amount.

A gst calculation tool or gst tax calculator india makes this easier. It helps with accurate financial calculations.

Common GST Rates and Their Applications

To understand GST, knowing the tax rates for goods and services is key. India’s GST system has different tax rates for various items. It’s important for businesses to know these rates to follow the rules and calculate taxes right.

0% GST Category

Some goods and services don’t have GST, like basic food, healthcare, and education. Businesses selling these items don’t charge GST. But, they can get back the GST they paid on what they bought.

5% GST Category

Items that are important but not free from GST are taxed at 5%. This includes some food, healthcare items, and public transport. This rate helps keep these goods affordable and brings in some money.

12% GST Category

Many goods and services have a 12% GST rate. This includes processed foods, some textiles, and hotel stays. This rate is in the middle and covers items that are not basic but are still common.

18% GST Category

Most manufactured goods and many services have an 18% GST rate. This includes foods that are not basic, restaurant services, and telecom services. This rate is standard and covers a wide range of products and services.

28% GST Category

Luxury items and some bad goods have a 28% GST rate. This includes high-end electronics, luxury cars, and some fun activities. This rate tries to make people think twice about buying non-essential, luxury things.

Knowing these GST rates is key for businesses to handle their taxes well and follow GST rules. Using a gst rate calculator or goods and services tax calculator makes it easier to find the right GST rate for your business.

Practical Examples of GST Calculation

Let’s look at some examples of how GST is figured out. These examples will help you calculate GST online for your business.

Retail Purchase Calculations

For retail buys, GST is easy to figure out. Say you buy something for ₹1,000 with an 18% GST. The GST is ₹180, so the total is ₹1,180. A gst tax calculator makes this easy.

Service Industry Calculations

In services, GST is based on the service cost. For example, if a service costs ₹5,000 with a 12% GST, the GST is ₹600. The total is ₹5,600. An india gst calculator online makes this accurate.

Inter-State Transaction Calculations

For sales between states, IGST is used. If a business sells ₹10,000 worth of goods to another state at an 18% IGST, the IGST is ₹1,800. The total is ₹11,800. An accurate gst calculator is key for this.

Composite Supply and Mixed Supply Calculations

For composite or mixed supplies, GST is based on the main supply’s rate. For instance, if a composite supply has goods with different GST rates, the highest rate applies. A gst tax calculator makes these complex calculations easier.

GST Calculation Tips for Businesses

To deal with GST, businesses need smart calculation plans. Getting GST right is key for following rules and saving on taxes. Here are some tips to help you handle GST calculations well.

Maintaining Proper GST Records

Keeping accurate GST records is key for easy GST calculations. You should track all invoices, receipts, and tax payments. This ensures your GST returns are correct. A gst calculation tool can help by automating data and cutting down on mistakes.

Understanding Input Tax Credit

Knowing about Input Tax Credit (ITC) is crucial for lowering your GST. ITC lets you get back the GST paid on what you buy, cutting down your tax bill. To use ITC, you need valid invoices and the supplier must have filed their GST returns. A gst percentage calculator can show you how much ITC you can claim.

Using GST Calculator for Invoice Preparation

A gst calculator for businesses is great for making invoices. It makes sure your invoices are right and follow GST rules. This avoids mistakes and keeps your image professional. Our online GST calculator makes making invoices easy.

Common Mistakes to Avoid

Businesses often make GST mistakes like wrong tax rates or not using ITC. To avoid these, stay up-to-date on GST rules. A reliable gst calculation tool can help you avoid errors and follow the rules.

By using these tips, you can make GST calculations simpler and follow GST rules better. Our GST calculator is made to help businesses, so you can focus on your main work.

Troubleshooting Common GST Calculation Issues

GST calculations can be tricky. But, knowing how to fix common problems helps a lot. When using a gst tax calculator India, you might face several issues.

Handling Fractional Values

Dealing with fractional values in india gst calculation is key. You must round off values right. GST rules say to round tax amounts to the nearest rupee.

Dealing with Multiple Tax Rates

A goods and services tax calculator helps with multiple tax rates. Make sure you use the right rate for your goods or services.

Resolving Discrepancies in GST Calculations

If your GST calculations don’t match, check your inputs. Also, make sure you’re using the right tax rates. An accurate gst calculator can reduce mistakes.

When to Seek Professional Help

If you’re not sure about GST calculations, get help. Complex deals or mixed supplies need expert advice for correct compliance.

| Issue | Solution | Tool/Resource |

|---|---|---|

| Fractional Values | Round off to nearest rupee | GST Calculator |

| Multiple Tax Rates | Apply correct rate based on goods/services | Goods and Services Tax Calculator |

| Discrepancies | Double-check input values and tax rates | Accurate GST Calculator |

Conclusion

Getting GST right is key for businesses in India. A good online GST calculator makes it easier. Our free GST calculator helps you figure out GST quickly.

With our gst calculator india, you follow GST rules well. It works on phones and computers and gives quick answers.

Knowing how to use our online gst calculator is important. It helps you deal with different GST rates. This is great for all kinds of businesses.

In short, our online gst calculator is a big help for businesses. It makes managing money easier. This lets you grow your business more.